Contents

Also the bankruptcy appears to be the source of such risk but at low level. This low level can be determined when the bankruptcy costs are low. Thus, bank must first able to analyses the above mentioned sources which could cause systemic risk in order to implement the tools to manage the risk. Briance and Ole , analyses the functioning of country-risk assessment.

Efficient data- Bank should have accurate and appropriate data on the delays of payment of credit by borrowers. This approach is called risk budgeting.VAR is merely one metric that gives you a general indication of how much risk is present in the portfolio. Value At Risk is expressed as a percentage of the portfolio’s value or as price units.

Banks faces a lot competition and at the same time financial risks too. These risk are uncertain and the banks could face them at any point of time so they need to be well equipped with the policies to handle these risk. The risk involves – Credit risk, Market Risk, Operational risk and etc. Effectiveness of the measure of risk can be through Information system by regularly evaluating the data and make changes in the policies with change in the market. Application of the Risk measure must be done in appropriate manner with the help of Market experts.

Download one of India’s best wealth management apps

A fund will either have a great upside or a great downside capture ratio, but not both. Like in the above case the upside is 90% and downside capture is 72%. The fund has an upside capture ratio of 90, which implies that the fund has managed to capture 90% of the Index’s upmove. The second investment may have earned a higher return this year, but it has a higher risk and likelihood of volatility in the future. This up and down trajectory of returns in the Mutual Fund NAV is what standard deviation captures and presents as an annualized number. The retail credit risk implies the risk involved when we finance an individual or small business through various means such as card, mortgage, or cash.

The Bank has developed its strategies in the different countries on analyzing the economic conditions of that country. With of IT widely it has created its risk management policies. A systematic transaction of the banks is being taken care of through a panel of Experts. There is a self-centralized system which finds the loopholes and failed application of the policies with in the bank itself.

The purpose of this blog is not to provide advice but to provide information. Sound professional advice should be taken before making any investment decisions. The bank will not be responsible for any tax loss/other loss suffered by a person acting on the above. Reinvestment risk occurs in the event of declining interest rates. For example, you invest in bonds at a specific interest rate and gain high returns. But with falling interest rates, you are unable to reinvest and avail that initial interest rate which gave you high returns previously.

Santomero – The paper is for the commercial banks in Northern America and the practice management of the risk in these commercial banks. It basically focuses methods of measuring risk on the financial risk in the sector and evaluation of these risks. The risks are connected to the prices and the position of the market at a stage.

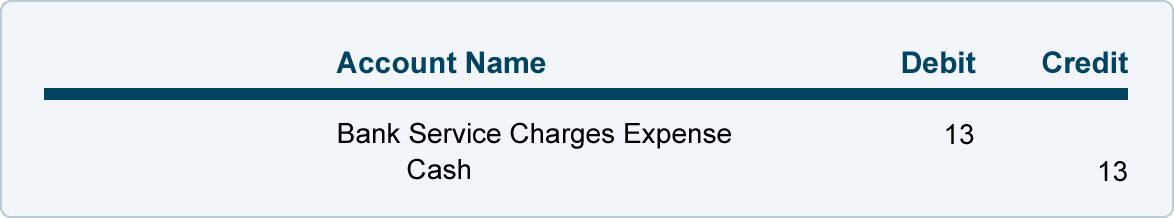

Value at Risk (VaR)

As an investor, you can use this information on Beta to align your Mutual Fund portfolio according to your risk appetite. For instance, if you are a conservative investor, you might want to focus on low Beta portfolios. Update your e-mail and phone number with your stock broker/depository participant and receive OTP directly from depository on your e-mail and/or mobile number to create pledge. Conditional VaR is the calculator of the average losses that usually occur beyond the VaR point within a distribution. The usual consideration is that it is always better to have a smaller CVaR. Acceptability- One of the biggest advantages of VAR is its acceptability among the regulatory authorities.

It is calculated based on the portfolio’s standard deviation and the rate of return as well as that of the individual security. Stock markets are extremely volatile and the probability of making losses is quite high if there is not a thorough understanding of the markets and the price movements. Investors and traders, therefore, give high importance to quantifying the risk through the measurement of volatility. However, the key shortcoming of such measurement is the indifference in the direction of fluctuations.

- This risk refers to the possibility that creditors may not receive their loans’ payment or receive it late.

- The modified state of affairs for threat management has thrown up many challenges for banks.

- Robert and John .The paper discuss in detail about the various types of risks.

- The most effective approach to handle investing threat is thru common danger evaluation and diversification.

- Hence, the result from different methods of calculating VaR can be different and lead to confusion.

Also, there is no standard process to collect the data relevant for analysis. In this method, the value at risk is calculated by creating a number of random scenarios for future rates. It uses non-linear price models for estimating any changes in the value for each such scenario and calculating the VaR based on the worst losses. This method is ideal to use in complex situations and is also the most flexible. However, if you are close to retiring and about to lose a steady income flow, you will have lower risk tolerance.

The Measurement and Management of risks in Banks

So, while the Sharpe Ratio is a valuable risk measurement tool and you should use it, it is advisable not to use it in isolation when comparing different Mutual Funds. If you use it wisely, R-squared can be useful while selecting a fund. In this blog, we will look at six risk measures that are generally used in analyzing Equity Mutual Funds. We will also explain how you can use these measures in selecting Mutual Funds.

In the monetary world, risk management is the process of identification, evaluation and acceptance or mitigation of uncertainty in funding selections. Risk management happens anytime an investor or fund manager analyzes and makes an attempt to quantify the potential for losses in an funding. Systematic risks, also called market risks, are dangers that can affect a complete financial market total or a large percentage of the total market. A downside capture ratio of less than 100 indicates that a fund has lost less than its benchmark during the periods when the benchmark has been in the red. If a fund manager has a down-market capture ratio of 82%, which indicates that it captured only 82% of its benchmark’s negative performance during market down ward timings. Investors should note that these ratios are calculated and exhibited in the fact sheet of the mutual funds.

Measuring Mutual Fund Risk

This ratio evaluate how well or poorly a fund manager performed relative to an index during periods when that index has dropped. The ratio is calculated by dividing the fund’s returns by the returns of the index during the down-market and multiplying that factor by 100 [(Fund’s Return/Index Return) x 100]. For a given level of risk taken, a higher active return will lead to a higher information ratio which indicates the consistency of a manager in delivering superior returns. The higher the information ratio, the better is the performance of the fund manager.

You just have to set a few parameters and the software does the rest for you . Thus, there is a 5% chance that a minimum loss of 15% of the portfolio (i.e. $3000) will occur within the next 1 month. In other words, we are 95% confident that the loss will not exceed $3000 within the next 1 month. Value at Risk can also be stated as a percentage of the portfolio i.e. a specific percentage of the portfolio is the VAR of the portfolio. For example, if its 5% VAR of 2% over the next 1 day and the portfolio value is $10,000, then it is equivalent to 5% VAR of $200 (2% of $10,000) over the next 1 day.

Most Mutual Funds in the Indian space have an R-squared of 80 or above. Below this number, the fund will not perform as a part of its index. Now, according to the MPT, the value of the overall portfolio will remain almost balanced because the hike in prices will cover https://1investing.in/ up for the loss. Mr. Markowitz received a Nobel prize for his work on this theory. People who choose these schemes are willing to accept market volatility for high rewards. These schemes are suitable for a person looking to stay invested for 5-10 years in the market.

Similarly, when options and other complicated financial instruments are taken into account, VaR calculations need the use of Monte Carlo simulation techniques. The returns on securities or portfolios are distributed using the Monte Carlo method of computing VAR. This is carried out in accordance with the analyst’s inputs regarding the historical return and security’s standard deviation.

5 Method To Evaluate The Performance Of Mutual Fund

Information ratio is extremely useful in comparing a group of funds with similar management styles. Standard Deviation indicates the volatility of the fund’s returns. Higher standard deviation means higher variation in returns and vice versa.

But of late many alternative investment options have also sparked curiosity among investors. It is calculated by subtracting the risk-free rate of return from the fund’s returns and then dividing the result by the standard deviation. Value at Risk is the calculation of the worst-case scenario that should be part of every decision-making process. It allows the investors or the managers to assume the maximum exposure and take remedial steps or choose between multiple options.

But as expected, this fund has had some good months and also some bad months with returns moving between +20% and -15%. A beta of -1 means that the fund moves opposite to the movement of the benchmark. If the benchmark rate increases by 1%, the fund’s returns would reduce by 1% and vice-versa. If the beta coefficient is 1 it means that the fund changes in sync with the benchmark. So, if the benchmark increases by 1%, the fund’s returns would also increase by 1% and vice-versa. As a ‘sense check’, you should look at the bottom line of the investment you are putting your money into.

Unsystematic danger is the risk of shedding an funding due to firm or industry-specific hazard. Therefore, the portfolio has a 10 p.c likelihood of losing more than $5 million over a one-year interval. There are 5 principal threat measures, and every measure provides a unique way to assess the risk current in investments which are under consideration. The five measures embody the alpha, beta, R-squared, standard deviation, and Sharpe ratio. Risk measures can be utilized individually or together to perform a danger assessment.